- Sub-Saharan Africa has a pipeline of 15GW (5% of the global total), down 47% since 2015.

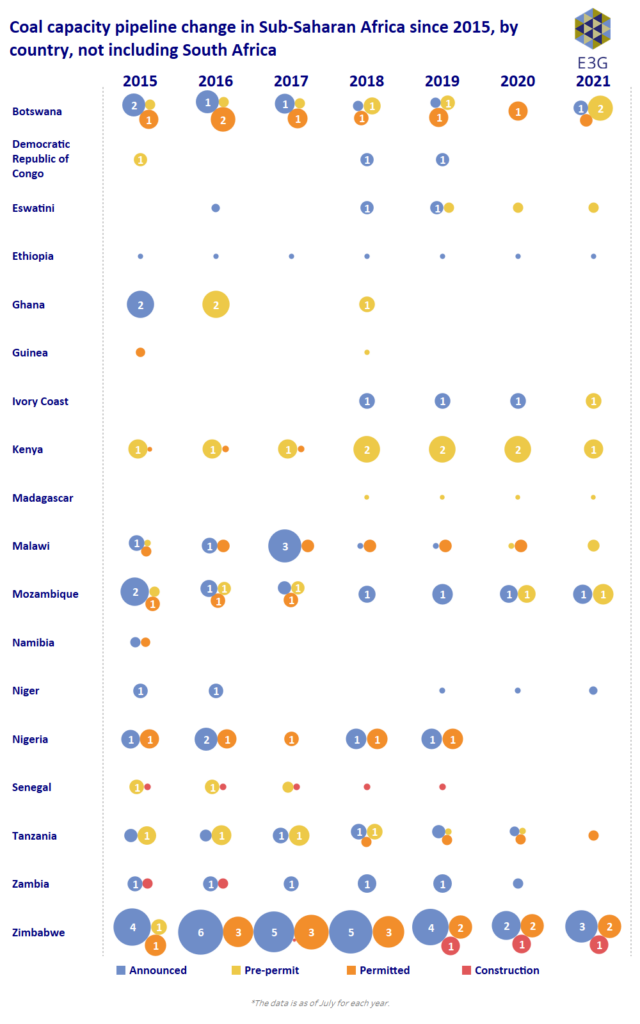

- Over this period seven countries have fully scrapped their pipeline.

- This leaves 13 countries still considering coal, but with only South Africa and Zimbabwe currently constructing new plants.

- Chinese financial institutions are involved in 13 projects in eight countries, totalling 11.4GW of planned capacity (76% of the total pipeline in the region).

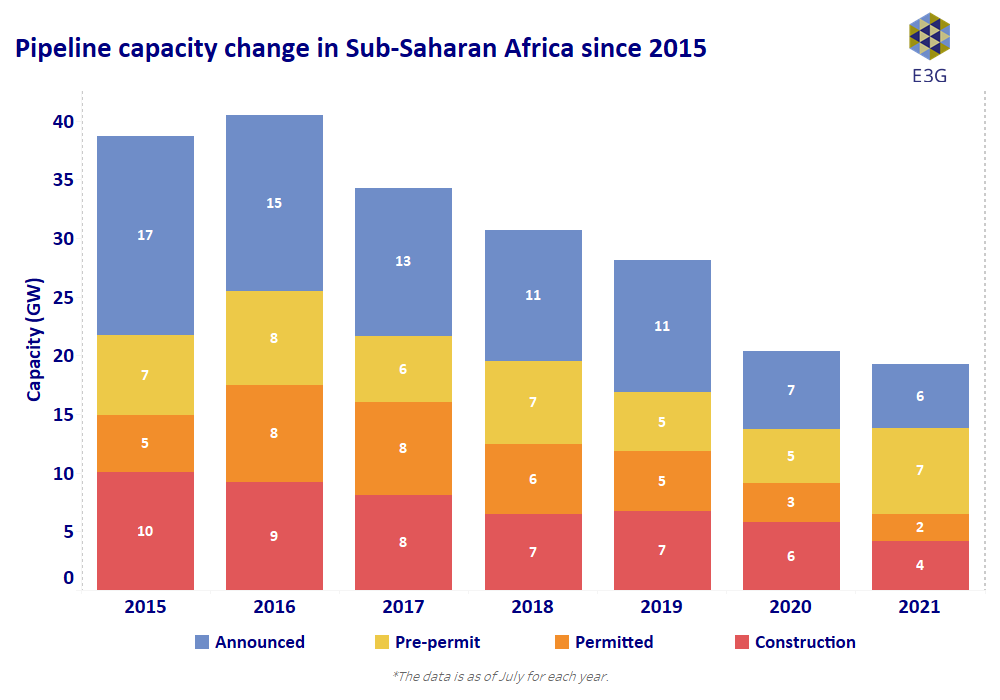

Figure 1: Pipeline capacity change in Sub-Saharan Africa since 2015. Click to expand.

The Sub-Saharan African coal project pipeline of 15.1GW accounts for 5% of the global total (13% of the non-OECD pipeline). This is a fall of 13.5GW (47%) since 2015, a period which has also seen seven countries scrapping their pipelines entirely (Figure 2). The region sees a broad distribution of capacity across a relatively large number of countries, compared to South-East and South Asia. Sub-Saharan Africa’s pre-construction pipeline is spread thinly across 13 countries, giving an average pipeline size of 1.1GW (compared to 7GW in South-East Asia, and 9.4GW in South Asia).

Many of these countries are facing multiple hurdles to bringing these projects to fruition, with international coal finance increasingly scarce. As in other regions, Chinese public investment in new coal remains, with Chinese financial institutions involved in 13 projects in eight countries, totalling 11.4GW of planned capacity, or 76% of the total pipeline in the region.

Cancelling such projects would help countries avoid locking themselves into an expensive and polluting energy source, and the risk of costly asset stranding. Targeted international support could accelerate their cancellation, including through support on the renegotiation of Power Purchase Agreements and the accelerated delivery of renewable alternatives.

Figure 2: Coal capacity pipeline change in Sub-Saharan Africa since 2015, by country, not including South Africa. Click to expand.