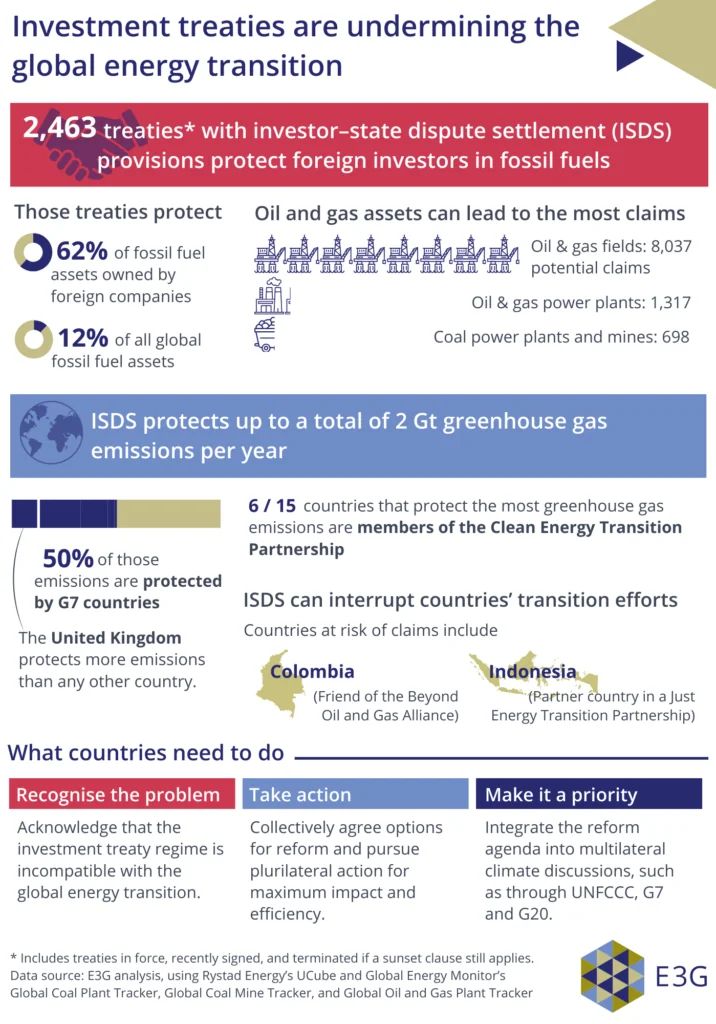

Globally, 2 gigatonnes (Gt) of carbon dioxide equivalent (CO2e) of potential annual greenhouse gas emissions is protected via investment treaties. The G7 is responsible for protecting 50% of these emissions abroad. Investment treaties with investor-state dispute settlement (ISDS) provisions are misaligned with international efforts to achieve net zero emissions. Countries with climate ambition need to lead the reform of investment treaties to eliminate the risk posed by ISDS to the global energy transition.

By mapping the global coverage of ISDS-protected fossil fuel assets, E3G has uncovered which countries protect the most greenhouse gas emissions via ISDS, and which countries are the most vulnerable to potential ISDS claims. The analysis in this report draws out how this protection is at odds with international climate efforts, such as efforts from the G7 and other climate initiatives, being led by countries with ambitious climate policies.

ISDS is incompatible with the climate crisis

ISDS provisions are at odds with global efforts to achieve a timely energy transition as they protect fossil fuel investments abroad. ISDS allows foreign investors to bring claims against host governments in international arbitration tribunals if their business interests are undermined by government measures. ISDS risks delaying the global energy transition by raising the costs of climate action, reducing the fiscal space to respond to climate change and encouraging further investments in fossil fuels.

Below we highlight some of the main findings from our report:

Expand each key finding below to find out more:

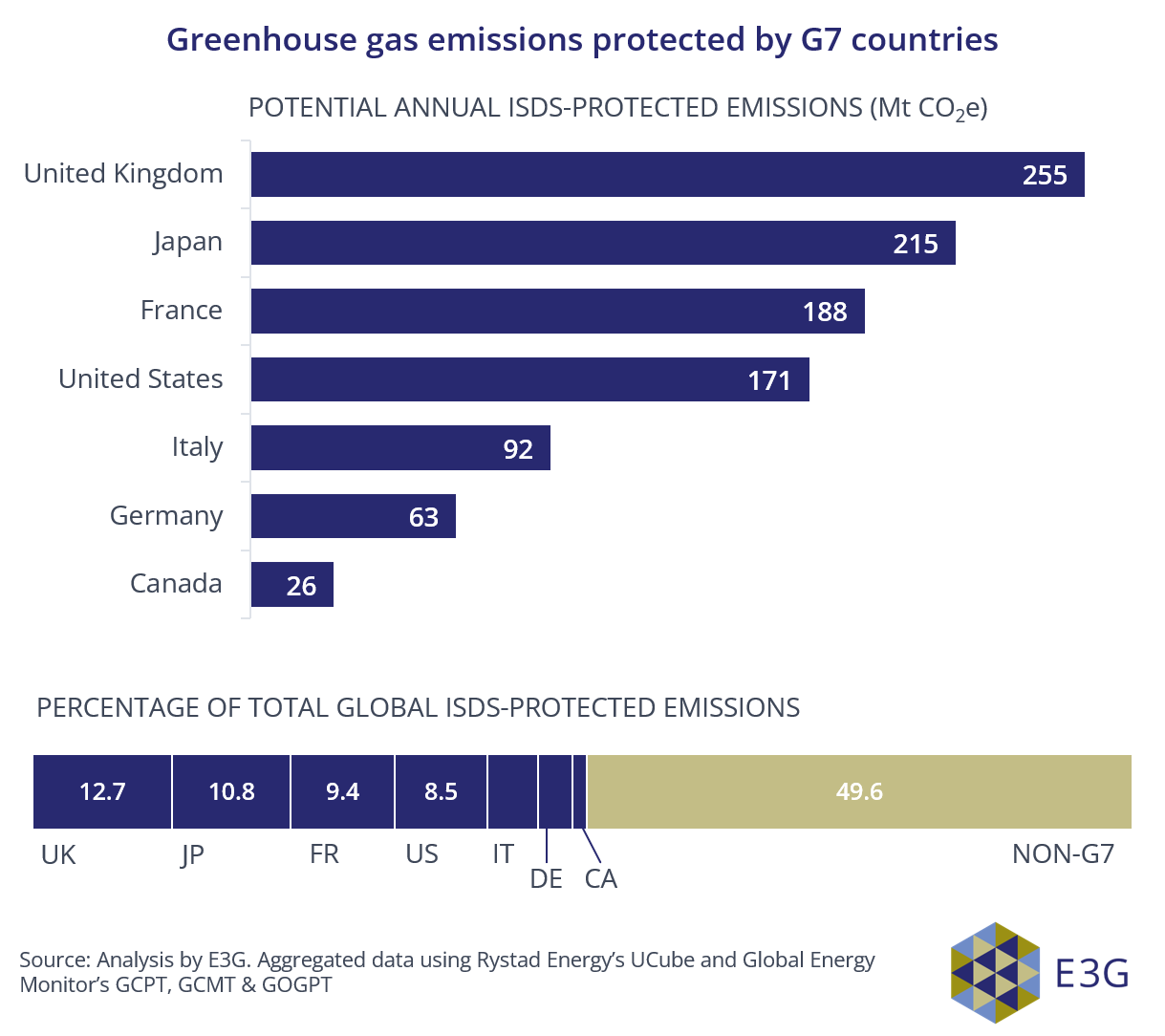

Parent companies headquartered in the G7 are responsible for 50% (1 Gt CO2e) of the potential annual greenhouse gas emissions arising from global fossil fuel assets. This equals 40.6% of the G7’s greenhouse gas emissions from electricity generation in 2022.

The United Kingdom protects more potential annual greenhouse gas emissions than any other country: 255 megatonnes (Mt) CO2e. That is 3.8 times the greenhouse gas emissions resulting from all UK domestic fossil fuel operations in 2022.

Egypt and Nigeria are at the highest risk of ISDS claims and both are lower-middle-income countries. Middle- and low-income countries are vulnerable to 60.4% of potential ISDS claims.

Colombia (a friend of the Beyond Oil and Gas Alliance) and Indonesia (supported through a Just Energy Transition Partnership) are also highly exposed to ISDS risk, which means ISDS can get in the way of their transition efforts.

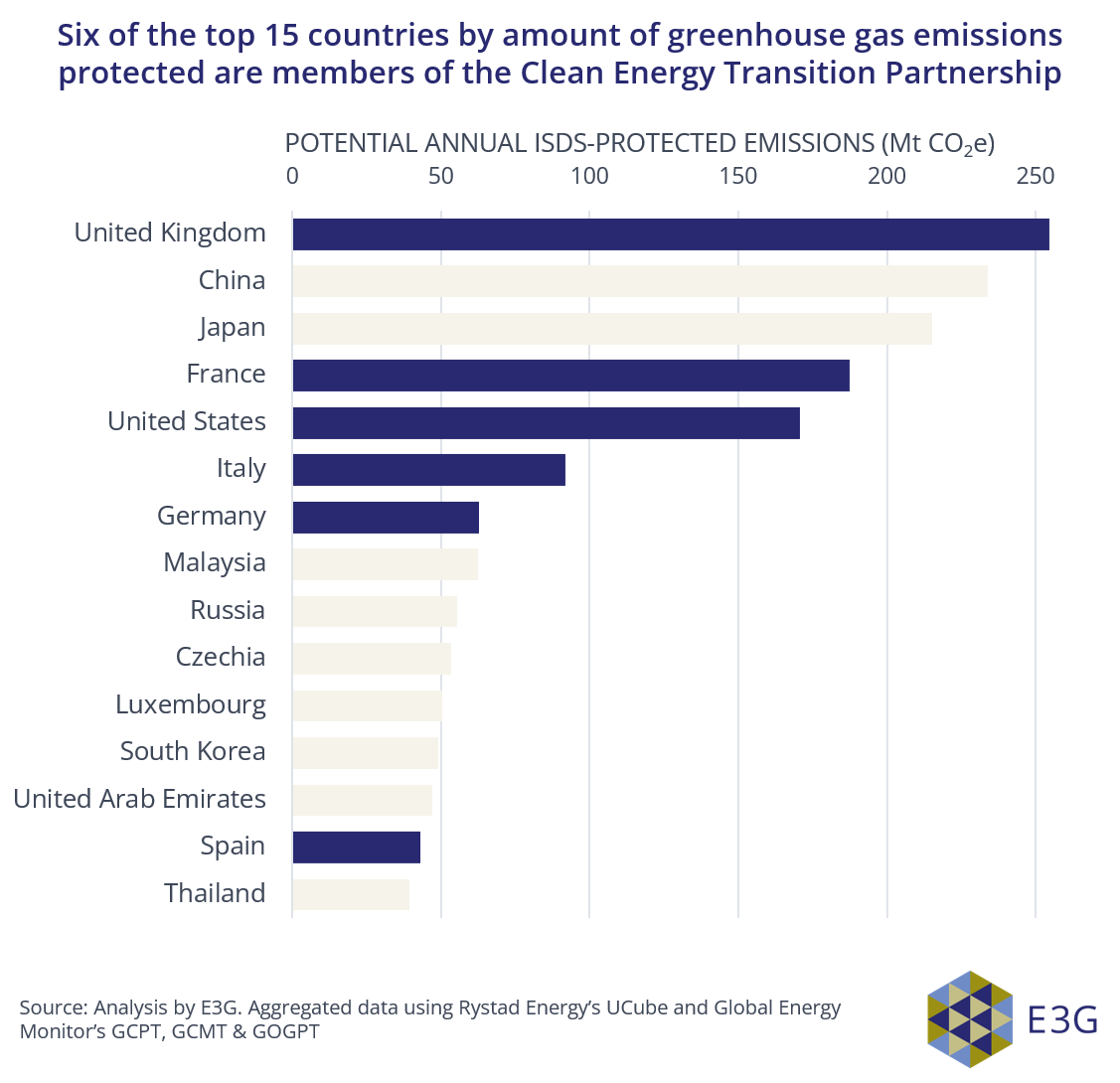

Six of the top 15 countries that protect most overseas greenhouse gas emissions via ISDS have joined the Clean Energy Transition Partnership (CETP). CETP members committed to end new export finance support for overseas fossil fuel projects. However, ISDS continues to protect investor interests in overseas fossil fuel investments.

Spain and France – core members of the Beyond Oil and Gas Alliance (BOGA) – together protect 165 Mt CO2e from ISDS-covered oil and gas fields. Despite being core members of the BOGA, they are slowing down the energy transition of other oil- and gas-producing countries via treaty-based investment protection.

Over a quarter of the national governments that are members of the Powering Past Coal Alliance (PPCA) have domestic coal plants that are covered by ISDS provisions. This coverage could affect the ambition of some of these national governments due to the potential risk of ISDS claims against the early retirement of coal plants.

Recommendations for the countries with climate ambition to act on investment treaties

- Recognise that the current investment treaty regime is incompatible with the global energy transition and consider options for investment treaty reform.

- Pursue plurilateral action by collectively agreeing a reform option that can address the incompatibility between the investment treaty regime and climate action.

- Integrate the investment treaty reform agenda into wider climate discussions in multilateral fora such as the G7, G20, and UNFCCC processes.

Read the full report and summary.

E3G worked with Tord Lauvland Bjørnevik at WWF-Norway to analyse upstream oil and gas extraction. The background, methodology, analysis of power plants and coal mines, findings, and recommendations was led by E3G and reflects its views alone.