Against the odds, COP27 brought an international deal on Loss and Damage finance. Climate-vulnerable countries had been calling for decades on the UNFCCC to ensure finance to address climate impacts. The G77 + China stood united in their position and proved their negotiating power.

Addressing the size of the Loss and Damage challenge will ultimately require a systemic response. This includes new sources of finance and reform to the global financial architecture. COP27 explicitly asked international financial institutions to consider at the April 2023 Spring Meeting how they can contribute to unlock funds that address climate losses and damages. For international financial institutions to succeed in their own mandates, they should be part of the solution.

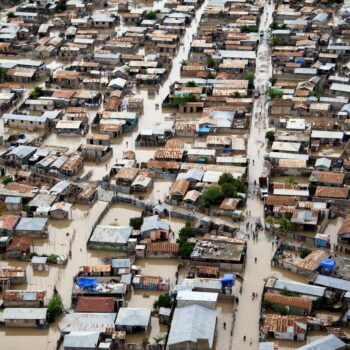

When the gavel came down, parties had signed up to both “new funding arrangements”, and a “new fund”, for Loss and Damage. For now, the bucket is all but empty – only a handful of countries have put a small amount of finance on the table. The German/ V20 Global Shield insurance-related initiative may offer relief for some countries in specific cases but is a far cry from adequately dealing with a problem developing countries did not create. While the commitments did help create some political momentum at COP27, pledges are in the millions when it is estimated that $400 billion will be needed annually by 2030.

The role of international financial institutions

It is in the interest of international financial institutions to ensure there is adequate, accessible finance for Loss and Damage that will contribute to the resilience of vulnerable communities and to global stability. Climate impacts are a threat to their goals, setting back economic growth and development, threatening macroeconomic stability, and entrenching debt and poverty.

An effective response is intrinsically linked to broader reform. Calls for change are coming from many sides – including the G20, the US Treasury Secretary, and the Barbadian Prime Minister’s Bridgetown Initiative, to name a few. Core to this demand is the recognition that international financial institutions are ill-equipped to respond to today’s climate crisis.

The G20 proposal to leverage MDB balance sheets through a renewed capital adequacy framework would also create space for more grant finance for Loss and Damage without requiring additional recapitalisation by shareholders. The IMF demonstrated during Covid-19 how it could rise to the challenge of a global crisis, providing $170 billion in assistance. Yet, the Resilience and Sustainability Trust, funded by reallocated Special Drawing Rights (SDRs), remains in its infancy and it is unclear how it can effectively respond to climate impacts.

What next for international financial institutions

International financial institutions can act now by strengthening their mechanisms to deal with climate impacts and plan for the inevitable increase in climate damages that will occur over the next 10 to 50 years.

The IMF and the World Bank need an ambitious response in 2023 to the COP27 invitation. This could include:

- Putting in place policies to reduce debt burdens of climate vulnerable countries to avoid reversing on development gains. This would free-up fiscal space for governments to allow them to rebuild and support their citizens.

- Addressing policies that do not properly consider climate vulnerability, such as the accessibility criteria for concessional finance that exclude many Small Island Developing States.

- Revising the Resilience and Sustainability Trust so that SDRs can be used to address loss and damage and consider alternative ways of channelling reallocated SDRs such as proposed by the African Development Bank (AfDB).

- The World Bank providing grants to cover insurance risks for most vulnerable countries to increase their insurance options.

- Requiring assessment of physical and transition risks in the IMF’s Article 4 consultations and financial sector assessment programmes and using IMF country reviews and multilateral development banks’ regional knowledge to monitor and address Loss and Damage through their expertise.

- Putting Loss and Damage on the agenda routinely for future annual meetings of international financial institutions.

Climate and finance cannot be seen in siloes – their success is interdependent, and it is time for the finance community to take climate impacts seriously.

E3G’s follow-up

In 2023, E3G will continue working on the reform of the IMF and multilateral development banks. E3G will also update its Public Bank Climate Tracker to assess the performance of Public Banks on Loss and Damage. We will continue to push for systemic approaches by governments and financial institutions to ensure greater resilience and reduced climate risk.