The Covid-19 pandemic heavily impacted coal power generation during 2020, particularly during H1. Steep declines in demand for electricity resulted in even larger falls in coal generation.

IEA figures released today report that coal power generation fell to 35% of global electricity production, down from 37% in 2019. This contributed to a 4% fall in CO2 emissions from coal across 2020.

Power plant load factors fell further and the viability of both operating coal power plants and new project proposals continued to decline. The growth in renewables saw coal challenged economically and operationally in multiple markets.

But while 2020 generation data tells us what happened last year, we need to dig into capacity trends to identify what is coming over the horizon. Our latest analysis, released today alongside the PPCA Global Summit, finds that there are three very different trends present across three categories of counties:

- Falling capacity: In the OECD and EU, retirements are accelerating and the last remnants of the new project pipeline continue to shrink. The only way is down, with coal phase out by 2030 now a plausible outcome.

- Rising risks: Only China saw its capacity and project pipeline grow in 2020, resulting in a net increase in operating capacity, despite 11GW of retirements. The pursuit of new coal by Provinces puts at risk China’s commitment to net zero by 2060.

- Pivoting from coal to clean: The non-OECD (excluding China) saw a continued reduction in the project pipeline, as governments start to take proactive action to restrict further coal plants being permitted and / or constructed.

OECD and EU highlights

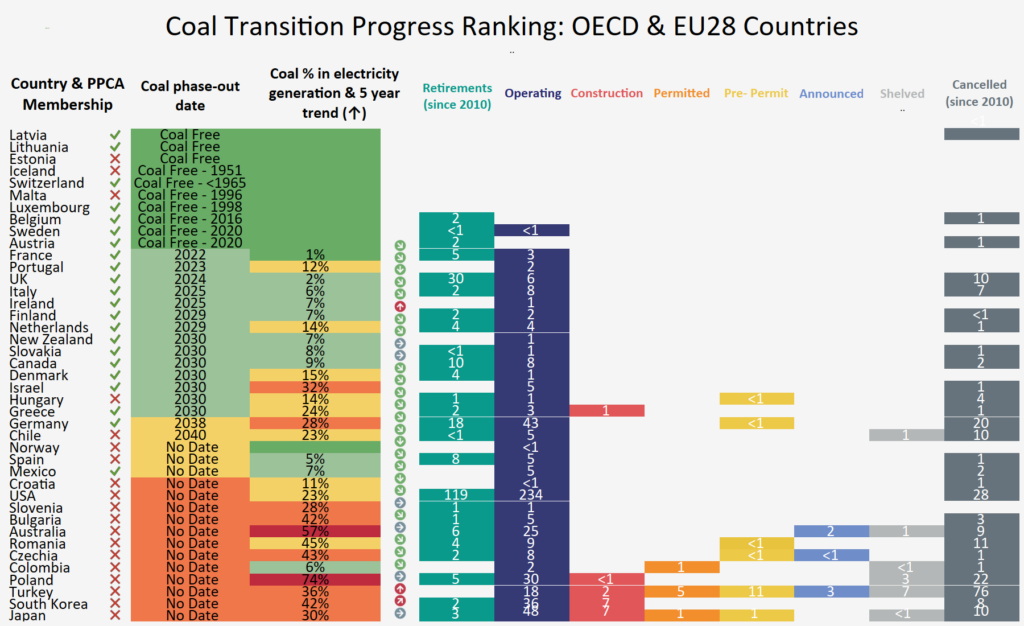

The OECD saw a net reduction in capacity of 23GW during 2020, following continued retirements in EU, UK, and USA. A further 194GW of retirements are already baked in and expected before 2030.

During 2020, the final coal plant in Germany entered into operation after a decade of disputes and delays. Only Japan, South Korea, Turkey and Poland have coal plants under construction. The pipeline of new projects under development shrank elsewhere. But Mexico dropped down the OECD scorecard ranking as government policies promote fossil fuels over renewables. Mexico was alone among the OECD in seeing a proposal made for a new (uneconomic) coal power plant.

OECD and EU progress led by members of the Powering Past Coal Alliance:

As of 2 March 2021, 56% of OECD & EU countries are members of the Powering Past Coal Alliance (23 countries).

Our analysis finds that 411GW (56%) of operating coal from the OECD and EU28 has either retired since 2010 (217GW), or is scheduled to retire by 2030 (194GW).

Of this, PPCA members are home to 147GW (36%) of coal capacity that has either closed since 2010 or will close by 2030. In parallel, coal retirements accelerated over the past four years in the USA, despite the pro-coal actions of the Trump Administration.

A further 29GW (4%) of OECD & EU coal capacity is scheduled to close, but not until after 2030 (and thus not yet aligned to a Paris-compatible phase-out pathway). This includes capacity in Germany, South Korea, Chile, Mexico.

The remaining 291GW (40%) of operating coal in the OECD & EU28 currently does not yet have a planned closure date. This includes 165GW in the USA, 26-28GW each in Japan, Poland and South Korea, 19GW in Australia, 18GW Turkey, and 7GW in Czechia.

The growing momentum towards no new coal

5 countries, became coal free during the course of 2020 by closing their last power plant (Sweden), or seeing projects cancelled (Oman, Nigeria, Niger and Egypt).

9 additional countries no longer have a pipeline of proposed new coal projects, including Germany, Hungary, and Romania. Beyond the OECD, Kosovo, Dominican Republic, Tajikistan, Taiwan, Ukraine and Zambia all saw the cancellation of their project pipelines.

Non-OECD countries beyond China saw a reduction in the size of the new project pipeline, with governments starting to take proactive action to restrict further coal plants being permitted and / or constructed:

- The forthcoming PDP8 in Vietnam, currently under consultation, will see a considerable reduction of the coal project pipeline.

- The Philippines Energy Ministry has announced a moratorium on new coal.

- In December 2020, PM Imran Khan announced that Pakistan will “not have any more power based on coal”.

- Bangladesh plans to scrap 9 proposed coal plants.

Under Pressure: China coal use in the spotlight

China alone now accounts for over half the world’s operating coal capacity, and almost as much of the project pipeline as the rest of the world combined. China saw increased construction and proposed projects in 2020, driven by Provincial responses to the economic downturn, despite overcapacity. The addition of 39GW of new capacity was three times larger than the rest of the world combined. This resulted in a net increase in operating capacity in China of 30GW, despite 9GW of retirements of older power plant. See GEM & CREA, February 2021.

China’s construction of new coal meant that the global capacity of coal power plants saw a net increase, despite retirements in the OECD and EU. The EU and Biden Administration have openly criticised China’s support for coal at home and abroad.

The impending 14th 5 Year Plan will be crucial for signalling whether the government will act to restrict coal capacity and encourage retirements to put it on a pathway to net zero by 2060. China has a track record of retiring subcritical coal power plants – already 68GW since 2010. It will need to develop an accelerated retirement plan for these less efficient units over the coming decade.

Overall, we see reasons for hope. Just 3 years ago this situation was implausible, but imaginable.

2021 offers great opportunities to accelerate action on the coal-to-clean transition, including of course a progressive G7 and COP26 host. Governments now know that they can’t ignore coal!