In October 2015, E3G published a G7 Coal Scorecard to provide a baseline assessment of how the G7 countries were addressing the challenge of reducing coal-fired power generation. It analysed the market and policy contexts of their domestic use of coal and their international influence. This G7 Coal Scorecard Update provides a summary of the significant positive progress of the past six months:

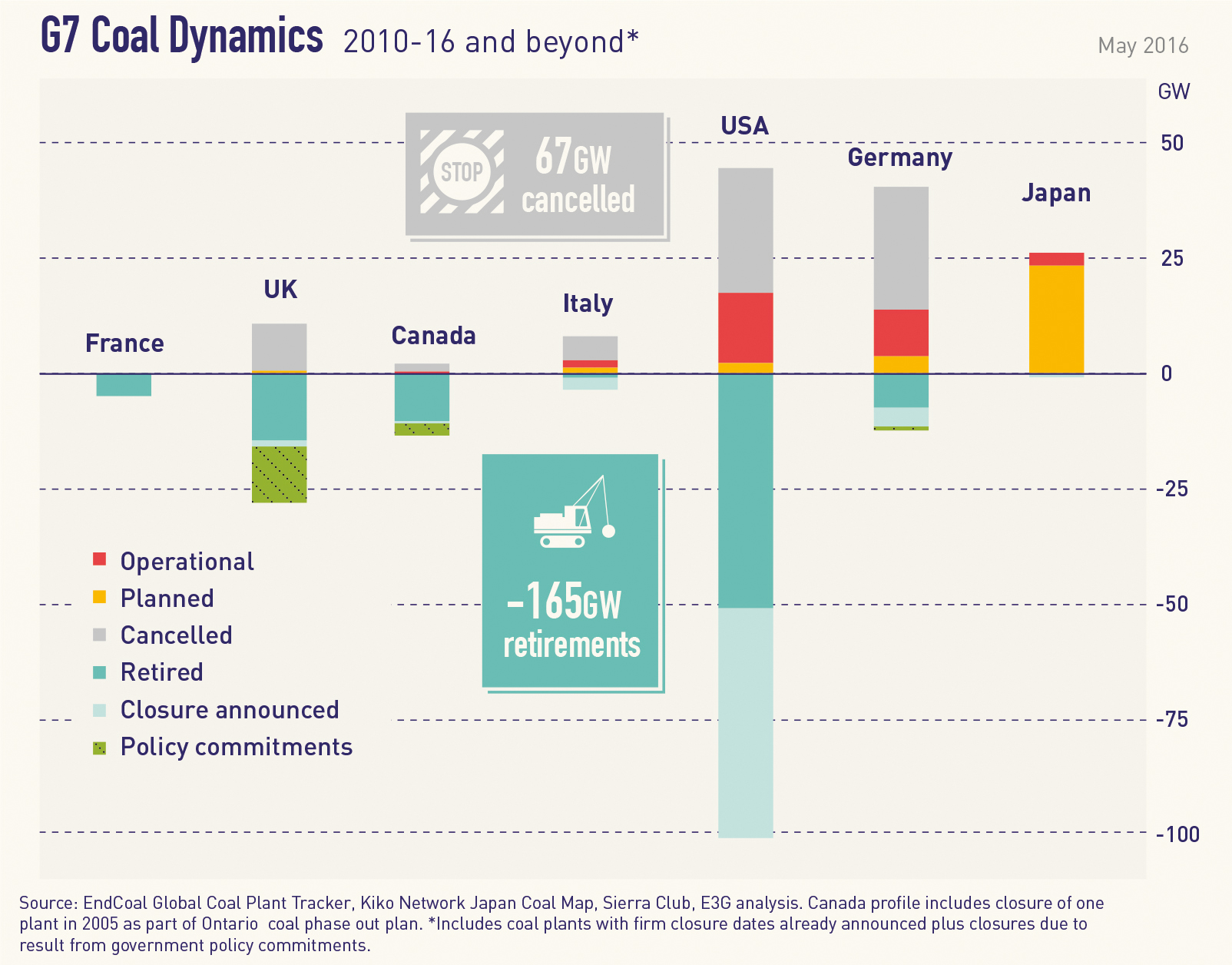

An additional 4 gigawatts (GW) of proposed new coal plant capacity has been cancelled, leaving Japan as the sole G7 country actively seeking to build new coal power plants. (See Figure 1 below)

40GW of existing coal plants have been added to the retirement pipeline for the coming years, which now totals 165GW. This accelerating pace of coal retirements is now the dominant structural dynamic in the electricity sector, and is increasingly now a shared challenge faced by the rest of the G7.

Policy makers are increasingly recognising the need for a complete phase out of coal power generation. Policy measures and transition plans are being developed to provide a managed pathway for power sector transformation. As a result, the UK, Canada and Germany have all improved their score.

- The UK government has committed to ending coal use in power generation by 2025. 4GW of coal plants have already closed in 2016 with more to follow. In early May 2016 the UK experienced multiple periods of zero electricity generation from coal, for the first time since 1882. The UK has improved its ranking in the scorecard and moves into joint second place with France.

- In Canada, the Province of Alberta has committed to ending coal use in power generation by 2030. Alberta is home to half of Canada’s remaining coal plants and so this is a significant step forward that opens the way for similar efforts at federal and provincial levels. The Canadian Government has also taken a more positive and proactive approach to coal in its international engagement, and has improved its score since October 2015.

- Germany has also improved its score in our assessment, as policymakers begin to grapple with the challenge of phasing out coal plants and enabling a just transition for mining regions. The first steps in this direction are being taken through a proposed lignite reserve policy that will withdraw a few power plants from the electricity market, but further efforts will be required to improve on this policy and enable a more rapid transition.

- In the USA, the coal plant retirement pipeline has now surpassed 100GW of coal plant capacity. Presidential candidates from the Democratic Party have set out proposals for transition plans and policy support for coal regions, increasing the likelihood of continued US leadership beyond the current Obama Administration. Internationally, the USA continued its proactive climate diplomacy in the run up to the Paris Agreement, helping to broker an OECD deal on the use of export credits for coal power plants. The USA remains in first place in the G7 scorecard.

- France is currently proposing the introduction of additional carbon price measures that could help further drive the retirement of coal power plants.

- In Italy, Prime Minister Renzi has asserted the need for coal plants to be shut. However there is as yet no indication of when a policy process will begin to put this into action. As the Presidency of the G7 in 2017 Italy has a great opportunity to enable a more proactive shared approach to coal phase out as part of its stated intention to prioritise climate action.

In contrast to these positive developments, Japan stays in last place in the G7 coal scorecard with no change in score since October:

- Domestically, Japan is still pursuing efforts to construct over 25GW of new coal capacity. Opposition from the Environment Ministry has been overruled in favour of a voluntary agreement with utilities to reduce emissions intensity. This approach is clearly insufficient given the scale of the challenge.

- Internationally, Japan agreed to participate in the OECD deal on export credits, but significant questions remain as to whether this will result in restrictions on its lending to coal power plant projects overseas. As the holder of the G7 Presidency in 2016 Japan had an opportunity to positively advance the post-Paris climate agenda, but to date has failed to do so.

Looking forward, the G7 Presidencies for the next four years will be held by Italy, Canada, France and the USA. This provides an opportunity for consistent G7 leadership on coal as part of international efforts to develop decarbonisation pathways to 2050 that are consistent with the Paris Agreement.

The G7 countries have a responsibility to act as pathfinders for the rest of the OECD and the G20. As the G7 moves into the Italian presidency in 2017 it should explicitly recognise that its members have to face a shared transition challenge over the coming decade(s).

Together with its OECD partners (including the International Energy Agency), the G7 can accelerate this transition through sharing best practice in power sector policy and the delivery of a just transition for regions and workers.

You can read the full report here – G7 coal scorecard update: Coal phase out commitments and closures [PDF 1.2Mb]