Canada, UK and Germany have all improved their performance over the past year. Private sector actors have been slow to move, but positive progress is now being made. Progressive governments must work together to reinforce real world trends.

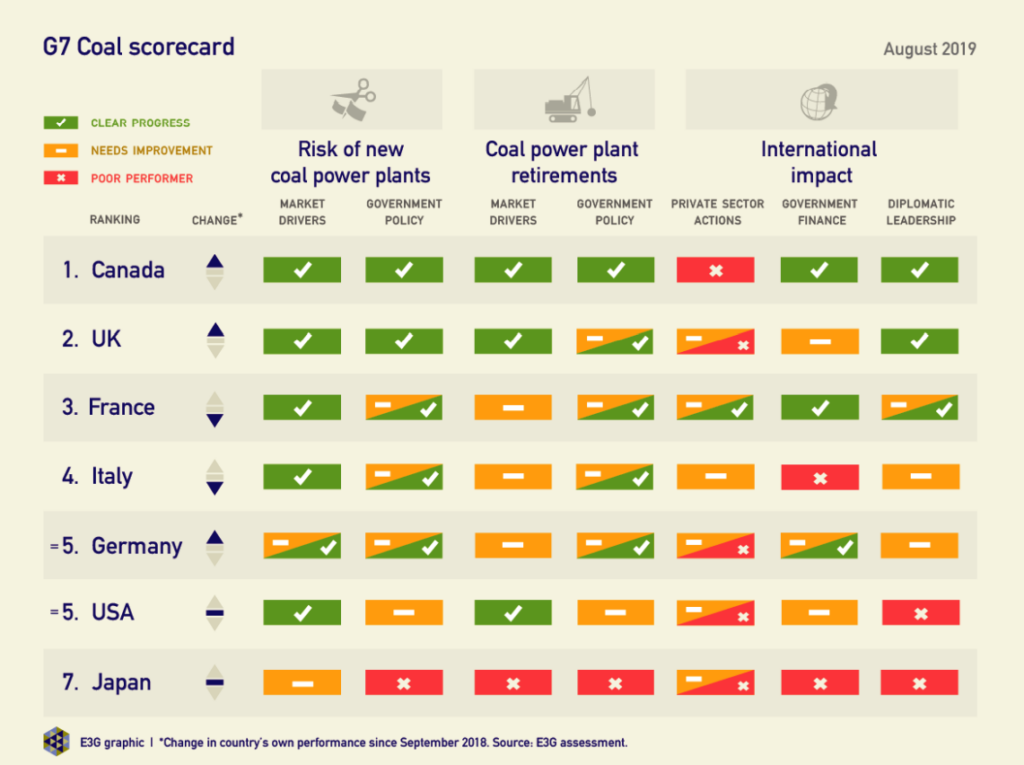

Figure 1 presents the 2019 G7 coal scorecard ranking, which reviews the status of market drivers and government policies in each country to provide a comparable assessment of performance. We consider whether there is a risk of new coal power plants being constructed; whether existing plants are being retired; and whether a country’s actions have a positive international impact.

Compared to September 2018, we assess that there have been the following changes to country performance and ranking:

- Canada has moved ahead into first position, demonstrating clear progress across all categories except for the international impact of its private sector. Over the past year the federal government has adopted new regulations that implement its commitment to phase out coal-fired power generation by 2030. The Canadian government’s international efforts on coal have been strengthened through the allocation of CAD $275m for coal-to-clean transition initiatives, while Export Development Canada has adopted a new climate change policy that ends its coal-related investments.

- The UK has moved up into second position ahead of France, as electricity market conditions have resulted in further reductions in electricity generation from coal and further closures of coal power plants. Unlike Canada, the UK has not yet introduced legislation to implement its coal phase out commitment and is still considering how it might tighten its approach to export credits and development finance.

- France has moved down from joint first to third position in the ranking, mainly due to improved performance by the UK and Canada. France is also yet to implement its domestic legislative approach to deliver its coal phase out. Internationally, France holds the G7 Presidency during 2019 and is co-leading efforts on Climate Finance and Carbon Pricing for the UN Climate Action Summit in September 2019. However, there has been relatively limited direct emphasis on coal across these initiatives, resulting in a slight reduction in France’s diplomatic leadership score.

- Italy remains in fourth position in the G7 ranking. Domestically, the coalition government reconfirmed the 2025 phase out date proposed by its predecessor but is yet to legislate for its implementation. However political tensions within the coalition have reduced Italy’s international influence on both climate change and coal, which has resulted in a weakening of its diplomatic leadership performance.

- Germany has made progress across four of the categories in our assessment over the past year and now moves up to joint fifth position alongside the United States. Significantly, the multi-stakeholder Commission for Growth, Structural Change and Employment (“Coal Commission”) concluded with recommendations for a phase-out of coal by 2038 at the latest, together with transition support for affected regions. This positive step forward needs to be implemented in law, while the end date should be accelerated to 2030 to align with international climate goals. Internationally, the national development agency KfW has also moved to end coal finance, but existing KfW loans as well as export credits administered by Euler Hermes have not yet been fully included.

- The USA remains in fifth position in the ranking, now jointly with Germany. Retirements of coal power plants have continued at pace over the past year, despite the Trump Administration’s attempts to prop up the coal industry. A slew of negative policy changes have been proposed by the Federal Government and regulators, but most are held up in legal challenges and are not impacting on real world trends as utilities and states continue to support a move from coal to clean energy.

- Japan, for the fifth year running, remains in last place in the ranking. It is the only G7 country still pursuing new coal power plants domestically and overseas. However private sector dynamics continue to run ahead of government policy, with close to 4 GW of proposed coal power plants being cancelled over the past year. The Japanese government advocated for an aligned international approach to ‘Quality Infrastructure’ under its G20 Presidency, but failed to take the opportunity to integrate necessary restrictions on high carbon infrastructure, including coal based power generation, at its G20 summit or as part of its Long-Term strategy (LTS).

Cancellations and retirements continue

In all five editions of our G7 coal scorecard, we have found that cancellations and retirements have been the major trends across the G7, except for Japan. Now, in 2019, we find that even Japan is also seeing an increase in the cancellation of proposed new power plants, leaving just 4.5 GW in its development pipeline.

At the same time, the momentum towards retirement of existing coal power plants has intensified with the addition of Germany to the group of countries actively seeking to phase out coal use. Across the G7, 118 GW of power plants are planned for closure prior to 2030, equivalent to 31% of current G7 operational capacity. Completed and planned retirements now total 264GW, a 22% increase since September 2018.

Coal finance heads for the exit

Over five editions of the G7 scorecard, we have consistently found the weakest areas of action have been those assessing public and private coal finance. However, going forward they have the potential to be the most transformative, where rapid and substantial progress can be made. This fifth edition of the G7 coal scorecard report reviews the extent to which financial institutions from G7 countries are still supporting coal overseas.

Government finance has seen incremental improvements across the five editions of the scorecard report, predominately through the tightening of export credit and development finance policies. The private sector category has seen the least progress, with relatively fewer improvements year on year. Positive steps are now being taken by finance actors in Germany, Japan, France and the UK.

Since the previous edition of this report, at least 30 new or improved policies limiting coal finance have been announced from both public and private institutions. These announcements demonstrate the increasing geographical diversity and size of institutions exiting coal, including across the G7. They include the Export Credit Agencies (ECAs) of Canada and Germany, US insurer Chubb, Italian insurer Generali, and the Japanese trading houses Itochu and Sumitomo (amongst others).

The writing is on the wall for coal, it is now up to financial institutions across the G7 to take the lead in setting global norms. Not only will this have a strong influence on their financial peers, but such actions will reinforce the soft power reach of government diplomacy. There is no doubt that progress in 2019 has been positive, the key question is how quickly all G7 countries will join the exit from coal finance to clean energy?

Progressive G7 countries must deepen their cooperation on coal

Altogether, the evolution of these trends is fuelling coal’s demise across the G7, setting a point of no return for the use of coal in the power sector. As a result, we expect more countries to present domestic policy frameworks that enable a managed phase-out of coal power generation. In response to these policy and market trends, governments have an opportunity to deepen their cooperation and exchange of best practice.

However, Japan failed to grasp the opportunity presented by its G20 Presidency in 2019, instead continuing to advocate in favour of exports of coal power generation technology. Similarly, the USA will hold the Presidency of the G7 in 2020, increasing the likelihood of a last gasp, pro-coal push, despite the evidence that coal generation is on its way out in the USA.

Progressive G7 members must therefore work together to continue to accelerate the transition away from coal power generation, including as a means of supporting the efforts of United Nations Secretary General Antonio Guterres, who has called for countries to stop building new coal power plants by 2020 and to curtail current coal capacity. In addition to its Presidency of the G7, France is co-leading efforts on Climate Finance and Carbon Pricing for the United Nations Climate Action Summit in September 2019. France can use this platform to bring together a coalition of countries and progressive private sector institutions that commit to ending coal finance.