This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris alignment | Reasoning |

|---|---|

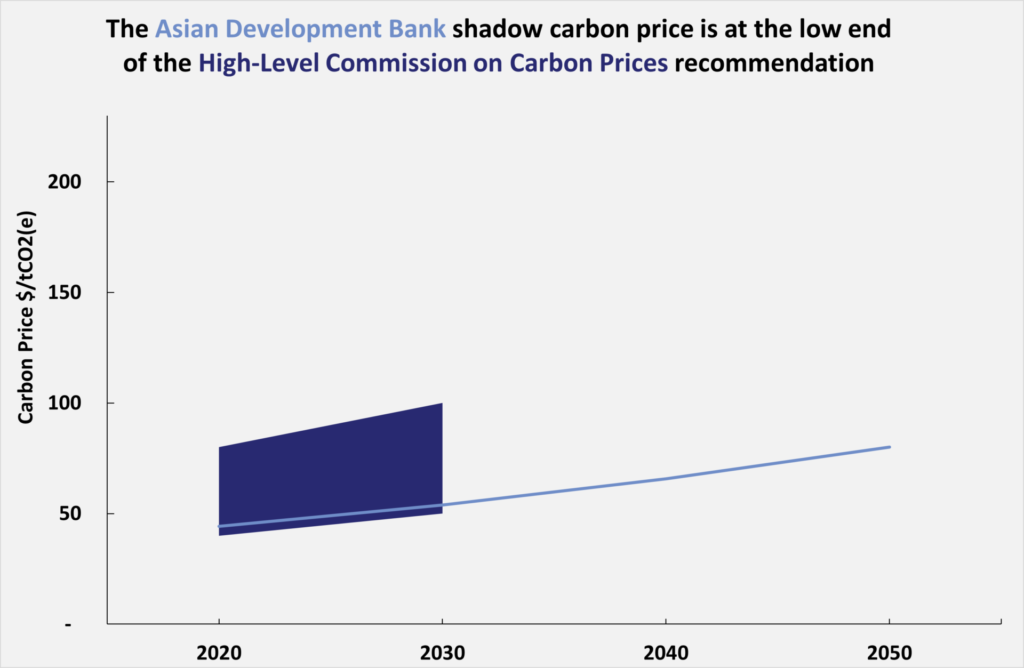

| Some progress | Carbon price is close to High Level Commission on Carbon Pricing minimum. Emission threshold could be improved, and Scope 3 emissions are not included. |

The Asian Development Bank does apply a shadow carbon price, the table below provides a summary of how it is applied across bank operations.

| Which projects subject to greenhouse gas (GHG) assessment | All projects which exceed a 100,000 tonnes CO2/year absolute emission threshold. E3G understands all projects are screened in terms of their GHG emissions and more detailed analysis is conducted once a threshold is exceeded. |

| Which projects apply shadow carbon pricing | All projects where costs and benefits can be quantified. |

| Price level | Borderline on minimum price recommended by High-Level Commission on Carbon Prices (HLCCP). ADB has the lowest carbon price in 2030. |

| How shadow carbon price is used | Says ‘should’ be used as basis for investment decisions. Applies the carbon price to the reduction or increase in project emissions against a baseline. Use of the carbon price as a hurdle and the broad coverage suggests good practice. |

| What is it compared to? | The “without project” baseline scenario may not necessarily be the status quo. In comparing project alternatives, the same “without project” scenario should be used throughout. |

| Are scope 3 emissions included? | No |

The graph below shows how the level of carbon pricing at the bank compared with those of the High-Level Commission on Carbon Prices (HLCCP). The HLCCP prices only extend to 2030.

Recommendation: ADB should apply a carbon price scenario to assess alignment with limiting warming to below 1.5°C, alongside the other MDBs.

Last Update: November 2020