This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

European Bank for Reconstruction and Development

Non-fossil to fossil energy ratio and scaling up climate investment in all sectors

| Paris alignment | Reasoning |

|---|---|

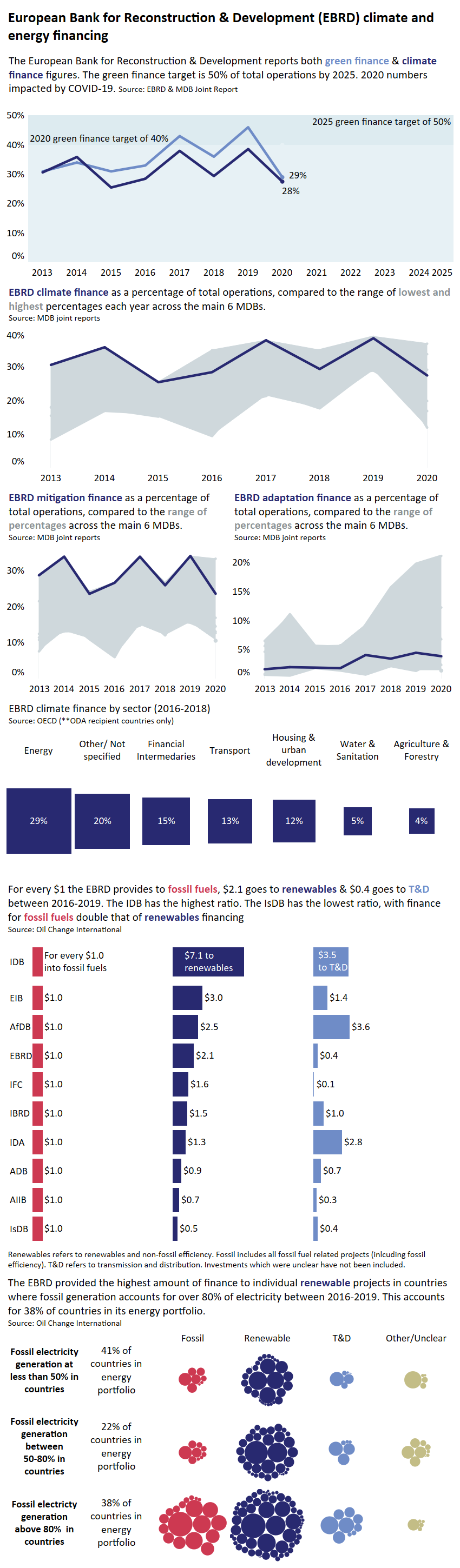

| Some progress | For every $1 the EBRD provides to fossil fuels, $2.1 goes to renewables & $0.4 goes to T&D between 2016-2019. |

Explanation

The European Bank for Reconstruction and Development (EBRD) exceeded its 2020 “green” finance target in 2019 but this has dropped due to the banks response to COVID-19 in 2020. This green finance includes financing to other environmental benefits other than climate mitigation and adaptation, and therefore is different and wider than the joint MDB definitions of climate finance.

It has had one of the highest levels of climate finance as a percentage of its total portfolio since 2013.

Its record on adaptation financing is relatively poor, and like the IFC this may be due to its private sector focus. However like the IFC it could improve its performance in this area.

Oil Change International (2018) Shift the Subsidies database

Joint Report on Multilateral Development Banks Climate Finance (2019,2018,2017,2016,2015,2014,2013)

This work is funded by Good Energies Foundation.