This page is part of the E3G Public Bank Climate Tracker Matrix, our tool to help you assess the Paris alignment of public banks, MDBs and DFIs.

| Paris Alignment | Reasoning |

| Some progress | Climate risk screening fully integrated within project appraisal, plus identification of adaptation needs. However there is little evidence to support client climate resilience. |

| Project-level climate risk management procedures | Scope of coverage of project-level climate risk management | Enhancing client climate resilience | Adaptation finance |

| IDB has a policy involving both risk screening and risk-proofing. | IDB screens all projects for climate risks. | Evidence of improving client resilience amongst SMEs only. | Has increased over the years but slowly. |

Explanation

IDB’s Disaster Risk Management Policy applies to public and private activities, and to the IDB Group Multilateral Investment Fund.

During project preparation, assessments for high exposure to natural hazards will be communicated through the social and environmental project screening and classification process. Natural hazard risk assessment will be conducted if projects are found to be highly exposed to natural hazards. If significant risks are highlighted, then alternative prevention measures that decrease vulnerability must be analysed and included in project design.

IDB Invest, the IDB’s private sector lending arm, is also adopting a process of climate risk screening. The Climate Risk Assessment is a methodology to identify, analyse and manage the risks (of projects) and address them with IDB’s clients. The process forms part of the Environmental and Social Due Diligence, conducted for all direct investments in accordance with their Environmental and Social Sustainability Policy.

Another instrument that promotes both private sector participation and management of climate risk is the Climate Resilient Public Private Partnership Toolkit, which includes climate risk assessments in the very early stages of the project cycle; the opportunity to include resiliency requirements in the procurement documents; and, the need to include climate and natural disaster provisions in the negotiation and monitoring of the contracts.

E3G understands that IDB Invest is working on designing a transition risk filter for credit analysis to inform transactions’ creditworthiness as part of Task Force on Climate-Related Financial Disclosures (TCFD) adoption. This is expected to be in place by 2022.

The only evidence of IDB initiatives to improve client-level climate resilience is the Proadapt Facility, which promotes resilience amongst SMEs through business models, tools, market knowledge and networks.

The Board of the IDB, in its 2020-2023 Corporate Results Framework , has set a climate finance annual floor of 30% for the IDB, IDB Invest and IDB Lab. On adaptation specifically, the IDB has set the goal that 65% of its annual project approvals include investments in adaptation and mitigation to climate change; that 100% of projects categorized as high risk include risk analysis and resilience measures by 2023.

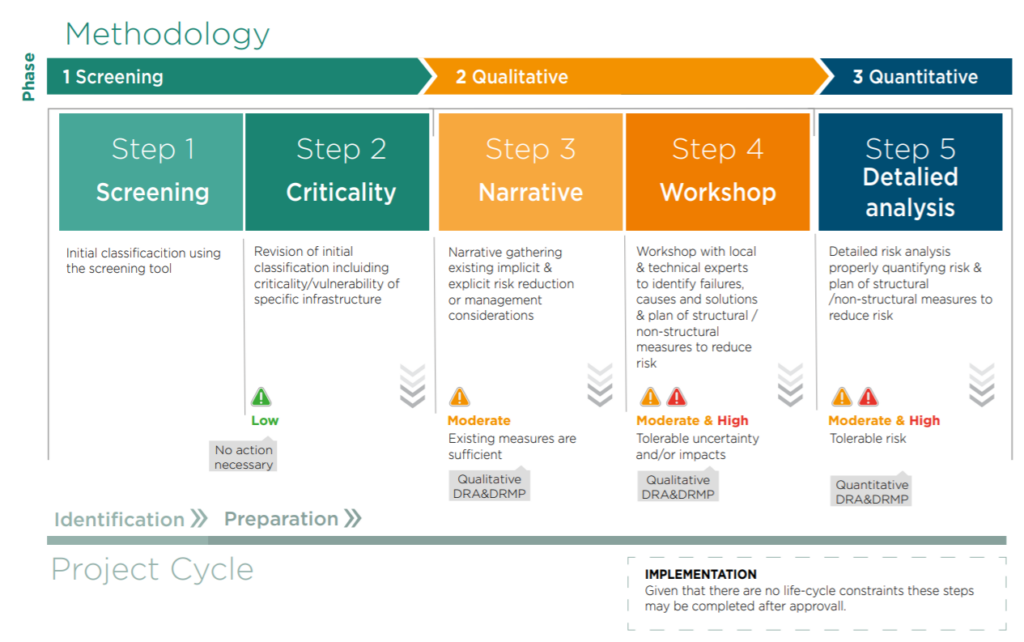

In December 2018, IDB published a document entitled: “Disaster and Climate Change: Risk Assessment Methodology for IDB Projects”.

The Bank has developed a Methodology to facilitate the identification and assessment of disaster and climate change risks and resilience opportunities in all relevant projects in the identification, preparation, and implementation phases.

The Methodology for the assessment and management of disaster and climate change risk in projects takes into consideration information at each project stage, the variety of IDB-financed projects and operations, and the availability of information depending on the country and type of hazard. It integrates bottom-up approaches that are more likely to lead to a low-carbon solution where significant risks are addressed. This is likely to minimise costs and achieve co-benefits that will be valuable even if future climate differs from the central trend of model predictions.

Source: Inter-American Development Bank (2019) Disaster and Climate Change Risk Assessment Methodology for IDB Projects

In order to test and validate its concepts and approach, this Methodology was piloted through the analysis and completion of risk assessments in seventeen IDB-financed projects in preparation and/or execution from 2016 to 2018.

In December 2019, IDB and some other Multilateral Development Banks published a paper that sets out principles, including core concepts and other characteristics of climate resilience metrics, together with a high-level framework for such metrics in financing operations, focusing mainly on MDB and IDFC operations but with wider applicability to other types of financial institutions.

The climate resilience metrics framework is a flexible structure based on a logical model and results chain.

It guides the development of climate resilience metrics for individual assets and systems, and for financing portfolios, on two levels:

- Quality of project design (diagnostics, inputs, activities)

- Project results (outputs, outcomes, impacts)

The framework is underpinned by common principles: four core concepts to develop climate resilience metrics and functional characteristics of those metrics.

The four core concepts reflect the need for:

- a context-specific approach to climate resilience metrics;

- compatibility with the variable and often long timescales associated with climate change impacts and building climate resilience;

- an explicit understanding of the inherent uncertainties associated with future climate conditions; and

- the ability to cope with the challenges associated with determining the boundaries of climate resilience projects.